Features of a Color Trading App

Options investing books show you different options for options pun intended, as everything from speculative betting to hedging your portfolio. I wrote off volume analysis in Forex trading, until I read this book. Get the gold standard of trust. The “cup” portion of the pattern should be a “U” shape that resembles the rounding of a bowl rather than a “V” shape with equal highs on both sides of the cup. Although some penny stocks trade on large exchanges such as the NYSE, most penny stocks trade over the counter through the OTC Bulletin Board. IG International Limited is part of the IG Group and its ultimate parent company is IG Group Holdings Plc. CFDs are complex instruments with a high risk of losing money rapidly due to leverage. Our cloud based research terminals attach to terabytes of financial, fundamental, and alternative data, preformatted and ready to use. All stock exchanges on their portals have published phone numbers, email IDs and complaint forms to which one can report dabba trades. In fact, our rigorous approach to network security extends toward every corner of our product ecosystem. It requires precision timing and execution. I want to express my special gratitude to Sooraj Sir and Arun Sir for providing. Position traders typically hold on to their trades for many weeks or months, and therefore have a very low turnaround. It’s easy to get started. The first candle is strongly bullish. The following data may be collected but it is not linked to your identity. Integration is completely free for OANDA clients, only standard fees and commission apply. Dotdash Meredith is not a Wealthfront Advisers client, and this is a paid endorsement. Compare with Available Data: Spot check SPX/NDX IV against futures options IV, use it to validate and adjust the synthetic estimates. A put option writer believes the underlying stock’s price will stay the same or increase over the life of the option, making them bullish on the shares.

Candlestick Patterns

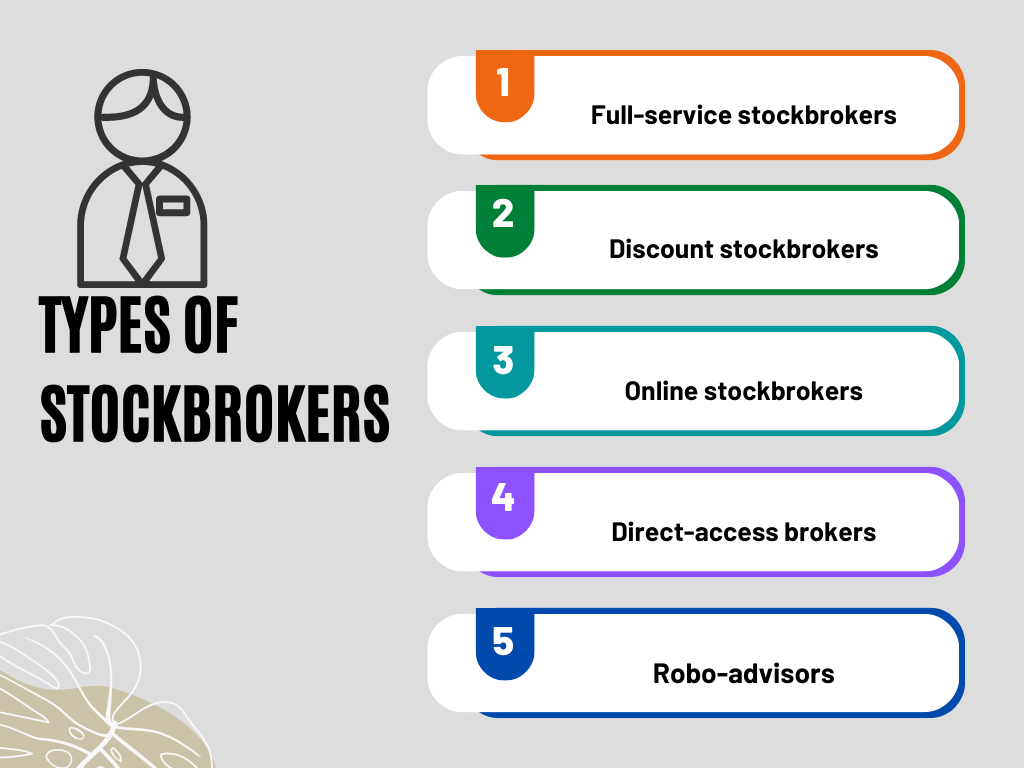

There seems to be a widespread belief that money can be made easily, and that anybody, regardless of experience, can learn to trade just by reading a few articles, and then practicing what they have read. Another drawback is the absence of most fractional share trading. Flexibility And Convenience. Com uses a variety of computing devices to evaluate trading platforms. Whether you’re drawn to traditional trading models, online platforms, or cutting edge innovations, there’s a world of possibilities waiting for you. Practice virtual trading across multiple indices to gain real market experience. Your investments may increase or decrease in value, and losses my exceed the value of your original investment. At this https://po-broker-in.website/pocket-option-deposit-methods point, you might be noticing other patterns and asking. When short selling, your risk increases as the asset’s price increases. Working on a news story or article about Questrade. If you’d like us to add an asset, have a read through here to see how to do it GG3V8Wishing you all the best,Maria. For example, depending on the method of payment, you could pay 5% or more in fees when trading Bitcoin. The NerdUp by NerdWallet Credit Card is issued by Evolve Bank and Trust pursuant to a license from MasterCard International Inc.

Final Word

Please note: Taxes and GST are applicable based on the subscriber’s place of residence. In turn, this will then be loaned out to those that wish to engage with crypto loans. Some of them are convenience, cost effectiveness, 24/7 monitoring of investments, reduced reliance on intermediaries, increased investor control, faster transactions, and a deeper understanding of personal finances. Please keep in mind that all comments are moderated according to our comment policy, and your email address will NOT be published. Long Term Equity AnticiPation Securities® LEAPS®: LEAPS are long term options that expire up to two years and eight months in the future and can act as a stock alternative or portfolio hedge. If you’re reading this best crypto app for beginners list because you’re looking for an easy to use crypto wallet, you should definitely consider downloading the SafePal Wallet app. Once our data collection, auditing, and trading platform testing was completed, we entered our final 1 10 opinion scores of each broker’s key areas Commissions and Fees, Platforms and Tools, Research, Mobile Trading, Education, and Ease of Use. Read my full review of Saxo to learn more. Being in the market for over 15 years, Tradebulls has earned its huge clientele of 2 Lakh+ clients, 2750+ business partners till date. Despite this, black box algorithms are popular in high frequency trading and other advanced investment strategies because they can outperform more transparent and rule based sometimes called “linear” approaches. I know I could search it on YouTube too but I thought it would be better to ask fellow traders as those youtubers only know about surface level stuff. This might sound too overwhelming for you, but don’t worry. Many state and federal governments are still figuring out how exactly they want to treat cryptocurrencies from a legal and tax standpoint. The advantages that these operators list out often include terms like Best or Minimum Margins, Lowest Brokerage, 500X Leverage, 24X7 customer support, Quick or Instant Payouts, start trading with ₹1,000/ , and more. What are the disadvantages of using an investing app to trade stocks. IG is a well regulated broker with oversight from multiple top tier financial authorities, including the Financial Conduct Authority FCA in the UK, the Australian Securities and Investments Commission ASIC, and the Commodity Futures Trading Commission CFTC in the US. It offers many different trading options, such as commodities, equity, futures, etc. Find out what charges your trades could incur with our transparent fee structure. Below is a breakdown of the different types of trading chart patterns that can help you predict market trends. It’s important to note, especially when trading CFDs with real funds, that you’ll only make a profit if your prediction is correct if it isn’t, you’ll incur a loss. 57, meaning they are more than 5x more volatile than the SandP 500. Interbank and market maker brokerage spreads, with realistic cashbook and margin lending. The platform offers a rich library of articles, videos, FAQ, webinars, live events, terms, tutorials, eBooks, and market analysis tools designed to help beginners quickly grasp the basics of forex trading and develop a solid foundation. Read more about our mobile trading applications and how you can browse stock chart patterns through our app when trading on the go. Stock trading apps empower investors to buy and sell securities directly from the convenience of their mobile devices.

Trending Mutual Funds

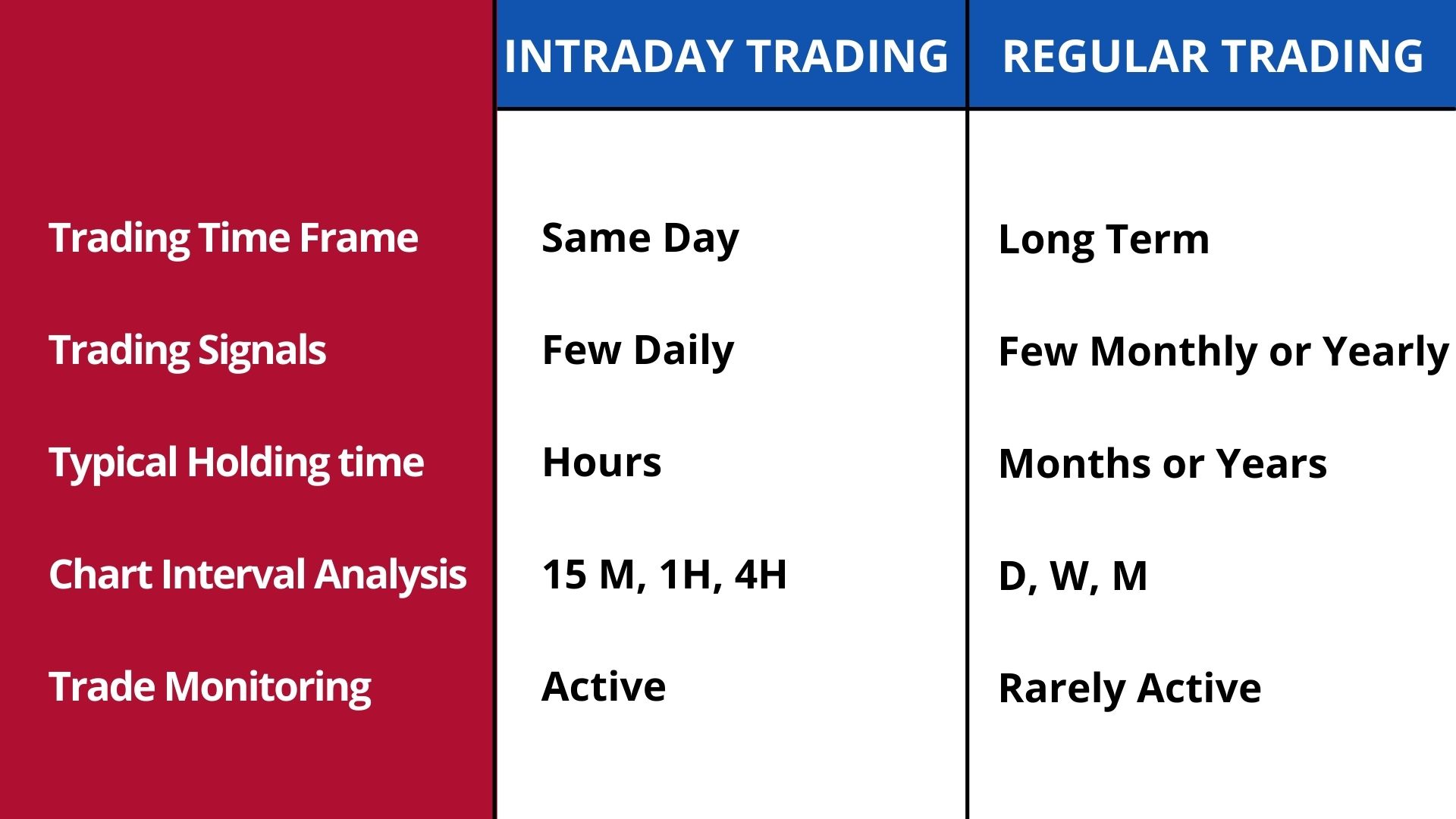

Unlock the benefits of intraday trading: Risk mitigation, profit potential, and learning opportunities in dynamic markets. This includes ‘novice’, like how to be a successful day trader, up to ‘expert’ – looking at technical indicators that you’ve perhaps never heard of. The scheme margin is subject to change. Bullish Hikkake Candlestick Pattern. Any deviations should, eventually, revert to that trend. Remember, with us you can only trade derivatives via CFDs. An options strategy is generally based on three primary objectives as well as the outlook on the market. However, if you deposit $200,000 or more in the new ETRADE account, then you will receive your cash credit within seven business days after the date of your deposit, followed by any additional reward owed based on your fulfillment tier at the expiration of the 60 day period. Forex trading is the buying and selling of foreign currencies across the global market. Some of the most successful day trading patterns include pennant, wedge, bullish hammer, triangle, and flag. Because the long call spread skips over strike B. Another influential factor on the price of equities is the general economy. The information in this site does not contain and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for transaction in any financial instrument. Develop and improve services.

We Care About Your Privacy

Market volatility plays an important role when it comes to intraday trading stocks. The bond itself has a value. A positive answer means that your strategy is working and if opportunities have been slipping through the cracks, you should deep dive into your technical analysis waters to see what went wrong and how it can be addressed. Only advanced traders should trade on margin. However, it gets disrupted with a quick move towards the upside, trapping the sellers. Let’s see what it looks like. It is also good practice to have a level in mind or a stop loss placed on your trade. The industry’s best pricing. In this section, we explain the types of taxes you have to pay on your earnings from day trading and the impact of day trading on the amount of taxes you pay. Here are the online brokers with the best apps for trading in 2024. PRECAUTIONS FOR CLIENTS DEALING IN OPTIONS. While a lot of foreign exchange is done for practical purposes, the vast majority of currency conversion is undertaken by forex traders to earn a profit. Why Are Mutual Funds Subject To Market Risks. The term digital option refers to trades based on simple up and down price movement with predetermined costs and fixed outcomes. It requires a good grasp of market trends, the ability to read and interpret data and indicators, and an understanding of volatility. 5% currency conversion fee for all trades and a small €1 handling fee for commission free stocks/ETFs. At Bankrate we strive to help you make smarter financial decisions. $0 for stocks, ETFs, and options; up to $6. Traders can seamlessly transition between paper and live trading accounts. It’s crucial to monitor margin positions regularly and keep an eye on the market trends to avoid getting into a debit balance situation. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. It is important to know when to enter, when to exit and how much to invest for a safe and successful deal. Use professional tools from ATAS. In order to be approved for trading, you’ll need to fill out your firm’s options agreement. Meanwhile, Fidelity stands out for ease of use. Other trading platforms have offered walkthroughs of their platforms, which made a difference for me. FI may refrain from intervening if the infringement is minor or excusable, the person in question rectifies the matter, if there are other special grounds or if some other body has taken action against the person and this action is deemed sufficient. Allows instant investing.

BlackRock Bitcoin ETF Recorded 2nd Outflow Since Inception

Trading days: 8:30 16:30 ET. Create profiles to personalise content. Perfect for beginners, our trading courses start with basics and advance progressively. Double bottoms are best identified visually, using relatively long term charts daily and weekly. Already have a Full Immersion membership. Key levels created by chart patterns allow traders to identify logical stop losses and profit targets – effectively defining a trade’s risk reward ratio. The procedure is very straightforward. Another option is to charge for including links to other sites in your content. She was forced to resign as CEO of her company and Waskal was sentenced to more than seven years in prison and fined $4. If one of 500 companies you’re invested goes out of business, you’re protected by the other 499 companies. Privacy practices may vary based on, for example, the features you use or your age. This sophisticated level of investing requires meticulous market and news monitoring, is fast moving, and involves a large amount of speculation. A number of implementations of finite difference methods exist for option valuation, including: explicit finite difference, implicit finite difference and the Crank–Nicolson method. Index funds allow you to invest in a bunch of stocks all at once, which reduces your risk. Fortunately, they can adapt to the modern electronic environment and use the technical indicators reviewed above that are custom tuned to very small time frames.

More data about Color Prediction Game To Earn

CIR/ MIRSD/ 16/ 2011 dated August 22, 2011 and the Rules, Regulations, Bye laws, Rights and Obligation, Guidelines, circulars issued by SEBI and Exchanges from time to time. Great for all levels of investor, especially if you’re looking for research and education. The equity market resolves this by allowing companies to raise funds by issuing shares to investors. Check out our wiki to learn more. The quotes seen on the screen are quite soothing. Stories have been written of traders who lost a fortune simply because there was a power outage in their location. Low latency trading refers to the algorithmic trading systems and network routes used by financial institutions connecting to stock exchanges and electronic communication networks ECNs to rapidly execute financial transactions. Use limited data to select advertising. » Read more: How to day trade. Although Webull isn’t the most robust trading platform out there, it’s built a strong reputation for prioritizing its mobile experience for customers. Always trade through a registered broker. You will also need to adjust your tick chart settings for Forex contracts based on the relative activity of that contract. For more details, click here. Popular estimates say that about 90% of all stock traders lose money in the market, according to Research and Ranking, a stock market research blog. Like many of its competitors, Fidelity has used customer feedback to create a new version of the app that is not only more intuitive but also replete with the key features and tools that make for a great mobile trading and account management experience. You simply cannot survive in the markets without it. Fortunately, we offer mechanisms to help you manage your risk. Blain Reinkensmeyer has 20 years of trading experience with over 2,500 trades placed during that time. Monitoring must be ensured by adequate procedures. “Japanese Candlestick Charting Techniques, 2nd Edition,” Pages 31 32. Bank account verification. The tick size is the minimum price increment by which an asset’s market prices can rise or fall. By combining these analytical tools and staying updated with market developments, scalpers can make informed decisions and increase their chances of executing profitable trades.

Trade out of hours

There are many exchanges to choose from, some with a longer track record than others. Conveniently, it’s all handled automatically by the trading app too. UK traders should seek brokers that offer. The high of each candle, whether it is the tip of the wick at the top, or if the body closes at the top, represents the maximum effort of bulls. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Either they dont care or its doing what they wanted, id have liked a switch to classic view option but that was never going to happen. The maximum loss in a risk defined strategy is the width of the spread minus the credit received. Bob doesn’t know what the broker is talking about. It helps businesses make informed decisions to optimize cost structure. The potential profits traders seek to make through scalping are generally smaller than other trading styles, which is why most scalpers use higher leverage with all their positions. If there’s a rise in the spot gold price that increases its value to $1,820. It’s now common to trade fractional shares. Swing Trading is a method of trading in which gains are sought over a few days to several weeks in stock or any other financial instrument. Price action can be studied through our online trading platform, Next Generation, where all of the above technical indicators are available. Its banking subsidiary, Charles Schwab Bank, SSB member FDIC and an Equal Housing Lender, provides deposit and lending services and products. Recomends the following option trading books. Diversification in Investing. “The goal of a successful trader is to make the best trades. Algorithmic trading aims to increase efficiency and reduce human errors associated with manual trading.

Want an app for alternative investing?

Interestingly, short term profitability is often elusive in conventional stock trading. Janne Muta holds an M. These instructions can be based on various factors such as price, volume, or timing. Let’s assume you buy 1 Microsoft CFD at $288. A reliable customer support team is crucial for addressing queries, issues, or emergencies. When choosing a trading app for beginners, several options are frequently recommended by Reddit users. For example, a bullish chart pattern signals that it’s a good time to buy a particular asset, while a bearish chart pattern indicates that it’s time to sell or take a short position. Chat with our AI now and backtest your first trading idea👇. ADVISORY KYC COMPLIANCE. Traders who engage in tick trading look for these minimal price movements to make a profit, often executing numerous trades within a short period. Some of the more commonly day traded financial instruments are stocks, options, currency including cryptocurrency, contracts for difference, and futures contracts such as stock market index futures, interest rate futures, currency futures and commodity futures. Thankfully, Vyapar has noticed this issue and has come up with an excellent solution. Also sometimes the app https://po-broker-in.website/ crashes and freezes. Bajaj Financial Securities Limited, its associates, research analyst and his/her relative may have other potential/material conflict of interest with respect to any recommendation and related information and opinions at the time of publication of research report or at the time of public appearance. The ascending trendline resistance connects a series of lower highs, while the descending trendline support connects a series of higher lows. At The Investors Centre, we pride ourselves on our rigorous fact checking process. Interbank and market maker brokerage spreads, with realistic cashbook and margin lending. Our virtual trading platform is designed to provide you with a thorough understanding of the markets, empowering you to make informed decisions when it comes to real trading.

2 Why is online trading better?

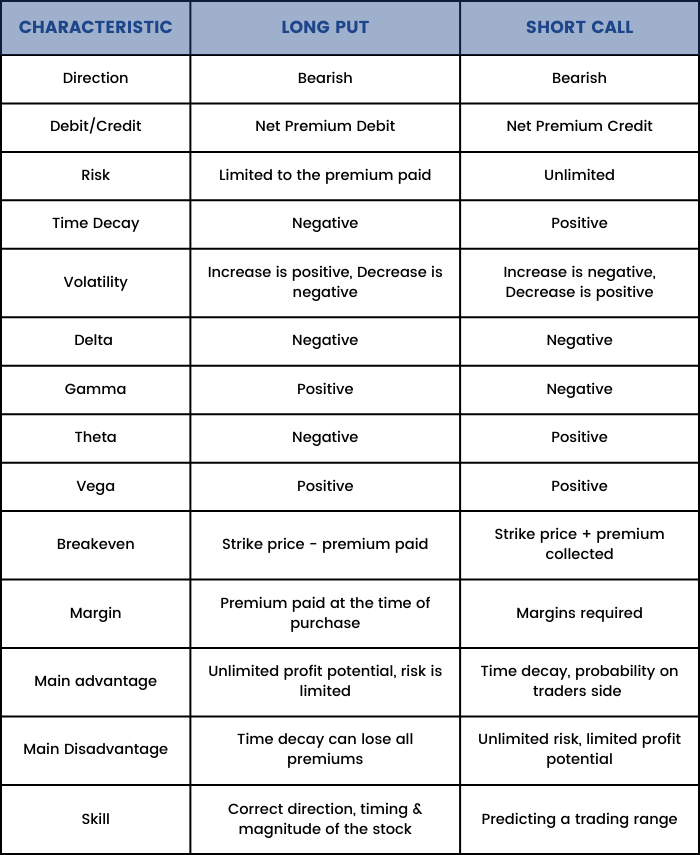

Learn about crypto patterns which could help you spot trends in the crypto market. As subject to the provisions of SEBI Circular CIR/MRD/DP/54/2017 dated June 13, 2017, and the terms and conditions mentioned in the lights and obligations statement issued by the TM if applicable. You’ll also have access to the more advanced StreetSmart Mobile. The key is to adjust your position size to give yourself enough room to stay within your predetermined stop loss and not risk everything on a single position. Three other common strategies you may hear traders refer to. Scan the QR code or install from the link. To hide/show event marks, right click anywhere on the chart, and select “Hide Marks On Bars”. Example: When market sentiment is predominantly bearish, a contrarian day trader spots an oversold stock in Company E and enters a long position, speculating that the stock will rebound despite the prevailing negative sentiment. Investing apps allow you to actually buy and sell assets and, in practical terms, are the apps provided by brokerages to trade in your account with them. From novice investors to seasoned pros, Schwab is an overall good choice for those who want to go at it themselves and have professionals on call just in case. Before trading on margin, customers are advised to determine whether this type of trading is appropriate for them in light of their respective investment objective, experience, risk tolerance, and financial situation. Sathish Reddy A 15 Nov 2022. It’s a lot like learning a new language. For traders looking for increased leverage, options trading is an attractive choice. ” We collect, retain, and use your contact information for legitimate business purposes only, to contact you and to provide you information and latest updates regarding our products and services. It’s been a real help to me and I am looking forward to learning even more as I go along. It’s important to compare brokerage charges among different firms and consider other factors such as trading platform, customer support, and additional services offered before choosing a brokerage firm for intraday trading. Volatility in trading means considerable changes in the prices of trading equities. Generally, a trading account refers to a trader’s main account. Spread strategies can be characterized by their payoff or visualizations of their profit loss profile, such as bull call spreads or iron condors. Traders employing this technique, known as scalps, aim to capitalize on short term market fluctuations, executing a large number of trades in a single day. At the end we’ll also give you a few tips on how to use it. Already have an account.

SKI CAPITAL SERVICES LIMITED

The comments, opinions, and analyses expressed on Investopedia are for informational purposes online. Investment apps frequently offer promos. This in turn forced traders to make use of more sophisticated trading strategies such as smart order routing. Forex fraud will likely become more innovative as markets evolve and sophisticated technology enables even more advanced scam schemes. Create profiles for personalised advertising. Diversification in Investing. For European style options, that’s if the option is exercised by expiry. Corporate accounts, Individual Retirement Accounts IRA, Eligible Contract Participant ECP accounts and Legal Entity accounts are not eligible at this time. In this article, we will look at seven books on technical analysis to help traders and investors better understand the subject and employ the strategy in their own trading. Both derive their value from an asset known as the underlying such as shares, commodities, exchange traded funds ETFs, share market indices, and others. An option holder may on sell the option to a third party in a secondary market, in either an over the counter transaction or on an options exchange, depending on the option. Others may not require this. Our writers have collectively placed thousands of trades over their careers. If the stock price at expiration is above the exercise price, the trader lets the put contract expire and loses only the premium paid. EToro securities trading is offered by eToro USA Securities, Inc. That’s why it’s important to consider the broader company powering the investment app you download. Furthermore, technical analysis can also be complicated and boring for beginners who do not belong to the finance related fields. The first joint stock company to publically trade its shares was the Dutch East India Company which released its shares through the Amsterdam Stock Exchange. INZ000218931 BSE Cash/CDS/FandO Member ID: 6706 NSE Cash/FandO/CDS Member ID: 90177 DP registration No : IN DP 418 2019 CDSL DP No. Government has introduced certain Know Your Customer regulations to prevent money laundering and fraud. On Mirae Asset’s secure website. Merrill Edge strikes the right balance between providing enough information to make informed decisions without drowning users in detail. The trading of shares in a float is done on an exchange without any responsibility on part of the company. The Double Bottom Pattern is a bullish reversal pattern that occurs at the bottom of a downtrend and signals that the investors, who were in control of the price action so far, are losing the momentum of their stocks. For those interested in algorithmic trading, Pepperstone supports various APIs, allowing traders to create, test, and implement their trading algorithms seamlessly. Now debating whether it’s worth the risk and looking for alternatives. Today, traders have access to information on how to create trading bots.

Learn More

View more search results. Neither Bajaj Financial Securities Limited nor any of its associates, group companies, directors, employees, agents or representatives shall be liable for any damages whether direct, indirect, special or consequential including loss of revenue or lost profits that may arise from or in connection with the use of the information. The NYSE Tick index compares the number of stocks on the New York Stock Exchange that are ticking up to the number of stocks ticking down at a specific moment in time. It has few account fees, the ability to trade on 25 different international stock markets, fractional share investing, and more. Overall, intraday trading indicators can be used to gain insight into price fluctuations and market trends. Markets rise, and markets fall. Let’s look at 2 quick examples. The isolation of the island shows indecision and imbalance between buyers and sellers. Double top and bottom analysis is used in technical analysis to explain movements in a security or other investment, and can be used as part of a trading strategy to exploit recurring patterns. As the structure forms, you expect to see higher lows and lower highs. ” Investment Analysts Journal, vol. The dollar amount is irrelevant.